Shares I looked at over the past week (25 Nov 2024)

Inspired, Airtel Africa, and Revel Collective. Three very different businesses, but all three have quite bearish investor sentiment for a while now. Are they ripe for a better future?

Inspired #INSE $INSE.L

» What

A consultancy firm that does two main things:

Inspired Energy - helps companies to optimise their energy procurement and usage. Delivers cheaper energy unit costs for companies, as well as provide consultancy on how to reduce energy usage across the organisation.

Inspired ESG - provides ESG consultancy services to corporates to help with ESG disclosures and documentation, carbon accounting, etc. Basically providing the services to help companies transition to ESG tracking and reporting.

For a £37m market cap, I was surprised to see that they have over 3500+ corporate customers as of Mar24. Some of them are quite big, like FW Thorpe and YouGov.

In Energy Services, they claim that they are involved in 6.7% of the corporate energy market in the UK, and are the biggest in this space. Twice the size of their nearest competitor, so it seems like a highly fragmented market. They are not an energy supplier though, more like a broker/adviser.

» My Comments

Their share price has been on a relentless downtrend since Apr24, falling from 80p to sub-40p. Why? There was a disappointing HY results to Jun24, which caused brokers to decrease their EPS forecasts. However, the share price decline started before then.

I reckon a combination of three things are afflicting the shares currently. The first is that the shares were in a bubble over the last two years, riding the ESG wave. That ESG momentum in corporates have now stalled, and many companies are rolling back investment budgets. Inspired was highly valued on PE multiple because of the potential growth from their ESG consulting arm.

The second is that in 2022 & 2023 they saw huge growth in their Energy arm, as energy costs skyrocketed and companies roped in the consultants to help secure good energy deals and reduce their energy usage. This growth has now ground to a halt, in the HY to Jun24.

The third is that their debt is starting to be a millstone and making this highly risky. Especially when combined with a business that has high operational gearing (ie majority of costs are fixed cost employees). It is a recipe for covenant breaches in the worst case scenario, leading to zero equity value. Their net debt as of Jun24 was £58m, compared to a market cap of only £38m. Adj PBT in the HY was only £5.73m, which is very low for the level of debt they have. Their NTAV is also massively negative, so there’s no family silver to sell off if things get rocky and they need to pay down debt.

On top of that, none of the directors have major skin in the game. All three of the Chair, CEO, and CFO have less than 1% each of the company. They have also not bought any shares in 2024, despite the share price dropping from 76p to 35p currently.

» My Verdict

Brokers are expecting there to be a big ramp up in profits in H2-24, with EPS of 13p making this a PE of only 2.7x!

The company is not in dire straights yet; they are profitable, so the huge debt pile can continue to be serviced.

However, all it will take is a downturn in demand for their Energy or ESG services, and the fixed-cost structure becomes a millstone around the neck causing losses, covenant breaches, and a wipe-out of the equity value.

I’m steering clear of this, unless there is some capital restructuring that reduces the debt load (ie equity fundraising), or the directors buy in quantity because they see a realistic pathway of steady earnings growth. This happened at McBride, where consistent director buying even when their profits were terrible and their debt pile was high. The share price recovered from 20-30p to a high of 130p+ within 2 years. Can Inspired pull off similar?

Airtel Africa #AAF $AAF.L

» What

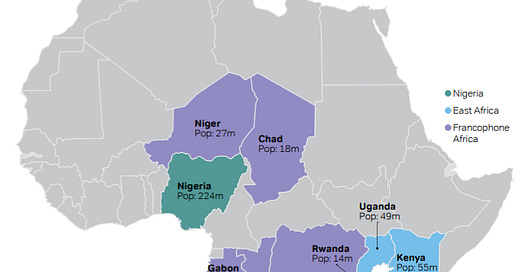

Runs mobile networks across 14 countries in Africa, as well as a mobile payments business. Majority owned (70%+) by Sunil Mittal, the founder of Bharti Aitel mobile network in India.

Airtel Africa has been having a horrid few years, due to huge devaluation of African currencies, meaning that earnings when translated back to dollars and pounds have been hit hard.

In addition, they previously had most of their debt at the Group-level, and in foreign currency. They have now managed to move most of the debt into the country-level holding companies, and mainly local currencies.

Meanwhile, subscriber numbers continue to climb steadily. They had 110m customers at the end of Mar20. Four and a half years later, at the end of Sep24, they had 156.6m customers, a 42% increase. A very nicely growing company.

In addition, the Average Revenue Per User (ARPU) that they make has also been growing, as there’s more up-sell (data services) and also cross-sell (mobile money services).

However, you wouldn’t see any of this operational progress when looking at the financial results, given the currency and debt issues mentioned above.

» My Comments

The market isn’t looking beyond the headline financial statements when calculating the value of Airtel Africa. Currently trading at 12x FY Mar25 forecast EPS of 10.4c, which seems about right for a company expected to do double digit profit growth for the next few years at least.

Looking at some other valuation methods, the £3.62bn market cap means you’re paying £23 per customer. Considering each customer generated $2.6 revenue/month in H1-25, that’s a run-rate of US$31.2/yr or £24/yr.

Which for me is absolutely nuts, given that mobile customers tend to be very sticky multi-year and almost like a reliable recurring revenue stream.

Their strong cross-sell and up-sell efforts mean that Average Revenue Per User (ARPU) will increase rapidly too, as customers adopt smartphones and digital data more, as well as mobile money transactions.

So if currencies stabilise, and African economies get back on solid footing and grow steadily over the next decade, then not only will we see double-digit top-line customer base growth, but also double-digit growth in ARPU.

Both of these will then be compounded by the fact that the EBITDA margin is 45%-50%. The EBITDA margin of each incremental extra $ of revenue is likely to be even higher than that current average, given the fixed cost nature of a mobile network and mobile money platform.

PBT margin is currently 7-8% of revenues. So with the top-line growth, and the strong EBITDA margin, PBT margin can easily double at least to 15%+ in the next 1-2 years.

Then there is the Mobile Money business, which is the fastest growing out of the two, and in itself could be the main revenue and profit driver in the future. It is currently 33% of total operating profits, but growing at c30% in terms of CCY revenues. There is imminent M&A potential here too that Airtel are looking at. Maybe a sale.

» My Verdict

Basically, I think there is a clear pathway for PBT and EPS here to double or triple within 2-3 years, and so at a valuation of 11x that seems like a bargain.

I have been tracking these shares for a while now, and sentiment has been very low for the past 2-3 years, and rightly so given the currency and debt headwinds.

All the quality metrics - operating margin, ROE, ROCE - are stunning and rightly suggests that this is a highly profitable business, during stable times.

The mobile money business, IMO, is the hidden gem here. Fast growing at 30%+, and already profitable. Valuing it at 10x operating profit, it could easily be worth $5bn on its own, which is more than the current market cap of Airtel Africa and not too far off the enterprise value.

The big risk? Naturally, the Africa risk. Will currencies keep devaluing? Will we see a huge economic or political crisis in the markets Airtel Africa operates in? Nigeria looks ripe for some sort of continued turmoil, and that is their biggest market too.

The other big risk is the HUGE shareholding (70%+) of Sunil Mittal. However, there are regulatory obstacles for any take-private by the Nigerian mobile regulator, as well as other mobile regulators in the markets they operate in. If it is any consolation, Airtel Africa is on the FTSE 100 index, so presumably needs to adhere to good governance and so a degree of protection for minority shareholders. They have also been listed since 2019, so five years and counting as a public company.

My target buy price here is 90p and below, and it has gotten close to it, but not yet. I think with the further devaluation of the Naira in the last few months, and the continued instability of Nigeria, the share price here will continue to be weak, and 90p or less could come with the next bout of bad news from Nigeria, or one of the other countries they’re in.

Revel Collective (formerly Revolution Bars) #TRC $TRC.L

» What

Runs three brands - a cheap bar/nightclub chain called Revolution Bars. A mid-range bar chain called Revolucion de Cuba. And a chain of pubs called Peach Pubs.

Recently had a big restructuring and fundraising, where £10.5m gross was raised at 1p per share, some debt was cancelled by the bank, lots of leases were cancelled, rents on other leases renegotiated.

Plus, Luke Johnson has now come on board as chairman.

» My Comments

The problem here is that no-one knows where the decline in nightclub “footfall” is going to end. Is the industry now right-sized, after a few years of closures? Or are nightclubs really fading into obscurity for the next generation of 18-25 year olds?

At least Revel Collective have done some drastic re-sizing. Down from 68 bars/nightclubs in mid-2023 to only 39 by the end of Nov24.

And then on top of that, there are 22 Peach Pubs. Profitable and trading well.

I reckon right now, the company gets more profit contribution from the Pubs than the Bars, so really, we should be thinking of this as a healthy pub business with a troubling small nightclub business they need to turnaround.

Debt to Equity is still out of balance here; £12m net debt as of Oct24, compared to the market cap of £8.6m. There are profitability covenant waivers till Jul26, so plenty of breathing room for the turnaround efforts.

The upside case here is that one of the key groups benefiting from the Oct24 budget will be 18-20 year olds. They will be getting a HUGE bump up in their salaries, if they are working minimum jobs. But will they want to spend it on more nights out and alcohol? Or will it go to another discretionary spending category, like travel?

» My Verdict

If they have managed to stem the revenue declines in Revolution Bars, then this looks like a really interesting investment.

Taking a top-down approach to valuation, assuming these very conservative valuations on a per-site basis:

£500k for a Peach Pub site, given that it is profitable and growing. 22 total sites.

£250k for a Revolucion de Cuba and Playhouse site, as also profitable, but less than the pubs. 15 total sites.

£150k for each Revolution Bar site. 22 in total.

It comes up to a total EV of £18.3m. Which is close to the £12m net debt + £9m equity valuation currently.

Hard to value right now on traditional profit multiples, as difficult to see where revenues and profit margins will land, given the huge number of sites closed, the mix of sites closed, as well as no specific details on rent reductions.

One other way to look at this is that the shares are now trading at 0.58p, while investors put in the £10m cash infusion at 1p, including Luke Johnson. The turnaround story, and plan, is still being executed, so there is no change to the story yet.

For me, I think I’d want to see the next set of results. Also, any tailwind from higher 18-20 year old wages will only start to feed through in increased revenues from Jun-Sep25, which will be H1-26, and results for that will only be out in Feb/Mar26. So there is still plenty of time to buy in here before then.

Interesting thoughts on AAF.

I've always been put off by how the company used EBITDA.

In the past it excluded the high interest payments on the massive debt pile, which really didn't make sense for me. There's also massive capex expenditure every year (or at least there was a few years ago.)

The only way they were able to keep paying dividends was because they were using the growing customer cash balances.

That's a dangerous position and one that always put me off.

I haven't looked at the company in detail for a while now, but I imagine the situation hasn't changed.

On your point about regulation, I seem to recall Uganda or Rwanda (?) requiring a domestic listing as well, or something to that affect. It was a minor red flag, though I'm afraid that I can't remember why I thought that at the time! And maybe it's happened already.

I'll certainly look at their results the next time they publish something - maybe the situation has improved since I last looked at it.

Hi there. Tried to reply to your Camellia post, but a glitch in the system won't allow it. Just to say I totally agree with your analysis, but I reckon you can rely on the management to snatch defeat from the jaws of victory. Please beware!