Nichols (NICL) - boring and mature soft drink company or exciting growth opportunity?

I might have discovered a company that has a bit of both going on at the moment! And the market is still valuing it as the former.

Bought in Sep24 at c990p. A medium size position (5-10% of portfolio), with the aim of potentially adding more as I get comfortable and the growth momentum solidifies.

Nichols plc #NICL $NICL.L is seen by many as a boring soft drinks company, and in many ways that is an accurate description. However, my interest got piqued by some unusual transformation and growth initiatives that are happening, which I think are currently not fully noticed by the market, judging by the low valuation given.

This, of course, is a sweet spot for the type of shares The Boon Fund looks for. Stable business, undervalued by the market, and with strong emerging catalysts for growth and profitability.

There are four sections to this in-depth post about Nichols plc:

A brief summary of what they do

Why I have invested

Risks to be cognisant about

The potential gains I see

A brief summary of what they do

Nichols is a soft drinks business. Yup - somewhat boring, they own soft drinks brands and the manufacturing facilities too. Their most famous brand is Vimto, which is one of the minor soft drinks brand in the UK, and has quite a love or hate relationship.

As a marketer, it is interesting that Vimto has high brand awareness and recognition in the UK, yet it looks like apart from a hardcore group of customers, most consumers will never consider Vimto. Thus, it has languished as a minor soft drink brand in the UK for ages.

Other brands in their portfolio are even more minor, including Levi Roots, Sunkist, Starslush….

All their brands are consolidated in one division, called Packaged.

Another division in Vimto is their Out of Home service, which provides beverages for hospitality and leisure providers. An example would be the slushie machine in a cinema, behind the concession counter.

Another interesting fact that I was unaware of is that Vimto is actually a global brand. It is sold in over 85 countries worldwide, and I’ll actually dig further into this below, as one my key planks of my investment thesis. In their Packaged business (where Vimto sits), 30% of total sales in H1-24 comes from international.

The founding family are still very much involved in the business, with various family members owning single digit percentages. Matt Nichols is a non-Exec, along with another Nichols on the board. A previous family member was Chairman until Oct23. There is an agreement that the founding family has 2 board seats as long as they own over 30% of the shares in concert, so its safe to say their shareholding remains above this, which is a key blocking stake for any takeover attempts.

Why I have invested

#1 - Vimto is actually a fast growing brand, not a mature brand

Vimto was invented in 1908, so its been around for a while. However, it is quietly doing well in the UK, and even better internationally.

In the UK, In H1 to Jun24, saw the highest ever annualised retail sales value, as well as what looks like strong market share gains overall. UK saw +5.3% revenue growth YoY, which is not too bad for a very mature sector.

In International, the biggest revenue share came from Africa, followed by ROW and then the Middle East. In total, International was 34% of Packaged revenues in FY23.

I want to dig more here, as I think this is where strong growth will come from, and potentially make International more than 50% of revenues within the next few years. There are two main drivers of growth here, which I will decompose into #1a and #1b sections.

#1a - Fast growth in Africa

Vimto is being rapidly launched into new territories across Africa, with Sierra Leone the latest in H1-24. In 2023, they had re-entered Gambia and Ivory Coast, along with new ranges launched in Sudan and Senegal.

A new production facility was also opened in Senegal in H1-24, to better service the market regionally. Coupled with the Sierra Leone launch, this should drive further growth in H2-24 and 2025.

However, revenue actually went backwards YoY in H1-24, decreasing by -10% to £11.8m. However, this was due to a one-off factor - because of strong comparatives with new market launches in H1-23. Revenues are still up 15% when compared to H1-22 (£10.3m) on a two-year basis.

Furthermore, when you look at a 5 year basis, FY23 revenues were +70% higher than FY19, a very strong growth rate. So I am prepared to accept H1-24 as a blip, and hope to see a resumption of strong growth rates for H2-24 and beyond.

#1b - Fast growth linked to Ramadan

All soft drinks are essentially similar - water, sugar, flavourings, and colourings. There is very little technical differentiation between products. Brand preference is the key to consumer demand, especially if there is a strong emotional brand affinity. The holy grail of any brand, or product, is to engrain themselves so strongly into the fabric of society and community, that it becomes an automatic choice.

An example is diamonds; millions of people a year automatically buy this stone when choosing an engagement ring, not even considering any other type of precious stones. But why? We are happy to wear other stones on other rings and jewellery.

Another example is KFC in Japan - it is now tradition for families to have a bucket of chicken to celebrate Christmas. Why? Nowhere else in the world does this, not even in the USA.

Then there is Uber, which is now a verb, and probably contributing to its dominance in English speaking markets. Despite competitors offering similar, and often cheaper, services.

In Disneyland, a theme park for children, many visitors are adults visiting for nostalgia. 40-50% of visitors to Disney world are child-free adults.

What do all these have in common? They have achieved an elevated brand status, where it is so ingrained culturally, that they become an automatic choice for people. Where there is no competitive substitute and the value gained from the product or service is the emotional benefits rather than the tangible benefits.

Vimto, over the past decade or more, has built a very strong association for Muslims to the month of Ramadan, an important time of year for every Muslim. It is seen, in many households as the default drink of choice, especially when breaking fast at sunset. This ingrained position of Vimto will pay dividends for decades to come, as children associate Vimto with the happiness and joy of breaking fast, and this ingrained emotional brand benefit stays for life.

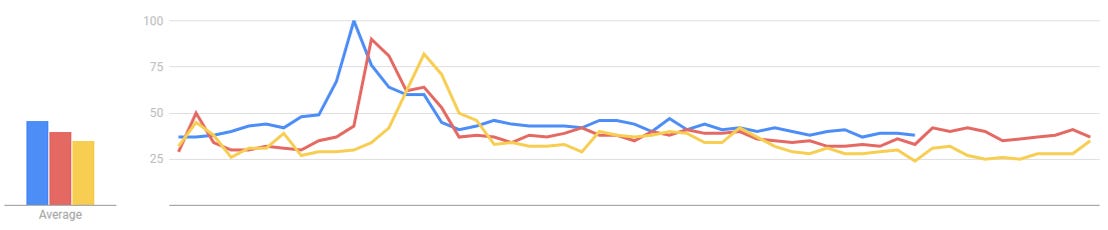

You can see this trend here, how Vimto is so intricately linked to Ramadan, by the peak you see in this Google Trends graph below. Note also how search interest is growing rapidly every year.

And here is how ex-UK revenues have grown, every year, since 2018:

You would probably expect the Middle East region, with the largest % of population as Muslim, to grow the fastest. But actually, it is growing the slowest, because that region was where the trend started forming, a decade or more ago. Vimto consumption is maturing in the Middle East. It has since spread to other Muslim populations globally, represented by the strong growth rates of +70% and +67% in both Africa and RoW, where there is ample growth opportunity yet for Vimto. And arguably, a much larger market than the Middle East.

#2 Out Of Home profitability recovers strongly

In 2022, a decision was made to restructure the OOH operations, as well as exit several unprofitable contracts. These two initiatives have largely been completed in H1-24.

We can see the improvements in profit already. We don’t have any prior divisional break-out numbers prior to 2023, but we can see that in H1-23, the OOH segment operating margin was 6.4%, and a year later in H1-24 it was 15.9%. A massive improvement! Revenues declined -11%, due to the exiting of unprofitable contracts, I assume.

I suspect we will see further margin improvements in H2, now that the final restructuring changes have been done in H1.

The contribution of OOH to segmental profits was only 12% in FY23, so this division will never be a needle mover for Nichols. However, it is good to see that the restructuring is now complete, and profitability is back up. Ideally, Nichols really should be looking to sell this division off, to focus on just the Packaged business. But it is good news that this problem division is no longer a problem or drag.

#3 The market is valuing Nichols as an ex-growth drinks company

When I looked at similar comparatives listed on the UK market, I was struck by the lowly rating that Nichols had.

Nichols has some strong top-line growth drivers for the next few years as detailed in #1 above, and also improved profitability to come in the next year onwards driven by #2.

Yet, when I bought in at c990p, it was trading at under 16.5x last twelve months PE. Even lower than AG Barr (17.8x) and Britvic (19.6x - with bid premium). And then when you compare to growth darling Fevertree, currently at 45x, you can see the potential opportunity for Nichols.

I can easily see a scenario where Nichols delivers a strong 7-10% yearly revenue growth, and operational gearing to drive a 10-15% EPS growth. This should get the markets to re-rate this to a 20-25x PE.

Especially as the balance sheet here is very strong; there’s also £70m of net cash as of Jun24. £20m was paid out as a special dividend in Sep24. If I assume a further £30m of the cash is surplus, Nichols is currently trading c15x LTM PE! Which is bonkers.

Risks to be cognisant about

» Geographic risk

Always a concern with regions such as the Middle East and Africa. Both the political risk as well as the economical.

The political risk would be a boycott of the Vimto brand, if there was a wider boycott of British brands and products. We have seen that with brands such as McDonalds, with the Israel-Gaza conflict.

However, it seems like the UK is becoming less involved in conflicts in the Middle East, judging by its muted involvement with the Israel-Gaza conflict.

In fact, there may be an opportunity, as American soft drink brands are further shunned/boycotted, and therefore Vimto has an opportunity to grow market share.

Economically, there is a risk that African currencies continue to perform weakly or see a sudden devaluation. We saw that risk recently with Nigeria, where PZ Cussons and Airtel saw a wipe out of profits.

» Sugar tax

Always a lingering concern that there are further taxes on soft drinks. However, there is little talk about this in the UK at present.

I did a quick search for the major countries that Vimto is sold in the Middle East and Africa, and did not surface anything to worry about either, for now.

The potential gains I see

» Top-line revenue in Packaged division looks to grow at a healthy rate going forwards.

The UK is doing well, with its +5% YoY growth rate in H1-24, hopefully to continue going forwards as it takes more market share.

ex-UK should see some high single or even double digit growth yearly, given the strong growth rates across Africa and RoW. In the next few years, ex-UK revenues might make up more than 50% of total, and Nichols then gets seen as a global company, rather than just UK specific, and potentially attract bid interest from some of the big soft drink conglomerates.

Operating profit in the Packaged division should have some operational leverage, as there is a degree of fixed cost canning / bottling infrastructure. In addition, as Vimto gains more traction, Nichols can sell licensing rights to more countries in RoW, which will be high margin.

Packaged division was 86% of total segmental operating profit before central costs. So strong growth here, in what I expect will be 7-15% annualised, will be the key driver of profit growth going forwards.

» Combination of strong EPS growth and also PE multiple expansion

Within a 2 year time period, I expect a 70p EPS to be very achievable, from the current 60.5p for LTM to Jun24.

In addition, with the market realising the strong growth prospects here, a multiple expansion to 22x PE gives a target price of 1,610p. Which is 60% more than the current price.

The shares has hit those highs before in 2018-2019, with similar share count and EPS, so seems quite a realistic scenario.

I suspect there might also be acquisition interest from larger global drinks brands. Nichols will be attractive given the high potential of the Vimto brand. As well as lots of operational synergies, in terms of manufacturing facilities as well as global marketing and distribution.

» Potential big shareholder returns to come

A special dividend of £30m, or 55p a share, was paid out in Sep24. The company is highly cash generative, and therefore its highly plausible that further special dividends will come in the next 1-2 years. The company has no major capital expansion investment plans.

Lets say even if for some reason profit growth goes nowhere, and the PE doesn’t re-rate. I reckon about 65p-75p of FCF can be generated by the company, and if 75% of that is disbursed to shareholders, that’s a 5% yield yearly. Which is not a bad return, and gives some downside protection if the shares do nothing in the next 2 years.

Nice write-up. I'm someone who loves Vimto as a nostalgic throw-back to cycling to the shop in the 90s to buy a Vimto and some monster munch. Had no idea about the Ramadan association today. Wish they did a sugar free fizzy version though - or if they do, they need to distribute it better. I'd switched to Irn Bru Sugar Free as a post work treat in recent years for that reason!